-

Home

Never Miss a Chance to Do the Most Good

Please enter your name, email and zip code below to sign up!

-

Who We Are

Never Miss a Chance to Do the Most Good

Please enter your name, email and zip code below to sign up!

-

How We Help

-

Disaster Services

Never Miss a Chance to Do the Most Good

Please enter your name, email and zip code below to sign up!

-

Empower Youth

-

Our Camp

Never Miss a Chance to Do the Most Good

Please enter your name, email and zip code below to sign up!

-

Youth Character Building

Never Miss a Chance to Do the Most Good

Please enter your name, email and zip code below to sign up!

-

Boys & Girls Clubs

Never Miss a Chance to Do the Most Good

Please enter your name, email and zip code below to sign up!

Never Miss a Chance to Do the Most Good

Please enter your name, email and zip code below to sign up!

-

Our Camp

-

Christmas

Never Miss a Chance to Do the Most Good

Please enter your name, email and zip code below to sign up!

-

Emergency Assistance

Never Miss a Chance to Do the Most Good

Please enter your name, email and zip code below to sign up!

-

Housing and Homeless Services

Never Miss a Chance to Do the Most Good

Please enter your name, email and zip code below to sign up!

-

Hunger Relief

Never Miss a Chance to Do the Most Good

Please enter your name, email and zip code below to sign up!

-

Serving Beyond the Corps

Never Miss a Chance to Do the Most Good

Please enter your name, email and zip code below to sign up!

-

Kroc Center

Never Miss a Chance to Do the Most Good

Please enter your name, email and zip code below to sign up!

-

Pathway of Hope

Never Miss a Chance to Do the Most Good

Please enter your name, email and zip code below to sign up!

Never Miss a Chance to Do the Most Good

Please enter your name, email and zip code below to sign up!

-

Disaster Services

-

Ways to Give

-

Angel Tree

Never Miss a Chance to Do the Most Good

Please enter your name, email and zip code below to sign up!

-

Volunteer

Never Miss a Chance to Do the Most Good

Please enter your name, email and zip code below to sign up!

-

Thrift Store

Never Miss a Chance to Do the Most Good

Please enter your name, email and zip code below to sign up!

-

Fundraise For Good

Never Miss a Chance to Do the Most Good

Please enter your name, email and zip code below to sign up!

-

Bed & Bread Club

Never Miss a Chance to Do the Most Good

Please enter your name, email and zip code below to sign up!

-

Make a Gift

Never Miss a Chance to Do the Most Good

Please enter your name, email and zip code below to sign up!

-

Register To Ring

Never Miss a Chance to Do the Most Good

Please enter your name, email and zip code below to sign up!

-

Make a Planned Gift

Never Miss a Chance to Do the Most Good

Please enter your name, email and zip code below to sign up!

Never Miss a Chance to Do the Most Good

Please enter your name, email and zip code below to sign up!

-

Angel Tree

-

Careers

Never Miss a Chance to Do the Most Good

Please enter your name, email and zip code below to sign up!

-

Contact Us

-

Prayer Request

Never Miss a Chance to Do the Most Good

Please enter your name, email and zip code below to sign up!

Never Miss a Chance to Do the Most Good

Please enter your name, email and zip code below to sign up!

-

Prayer Request

- Stories

Never Miss a Chance to Do the Most Good

Please enter your name, email and zip code below to sign up!

Never Miss a Chance to Do the Most Good

Please enter your name, email and zip code below to sign up!

Never Miss a Chance to Do the Most Good

Please enter your name, email and zip code below to sign up!

The Salvation Army in Maryland, Virginia,

West Virginia, and the District of Columbia

We are right next door. Find a Salvation Army unit near you.

Recent Stories

LEARN MORE ABOUT US

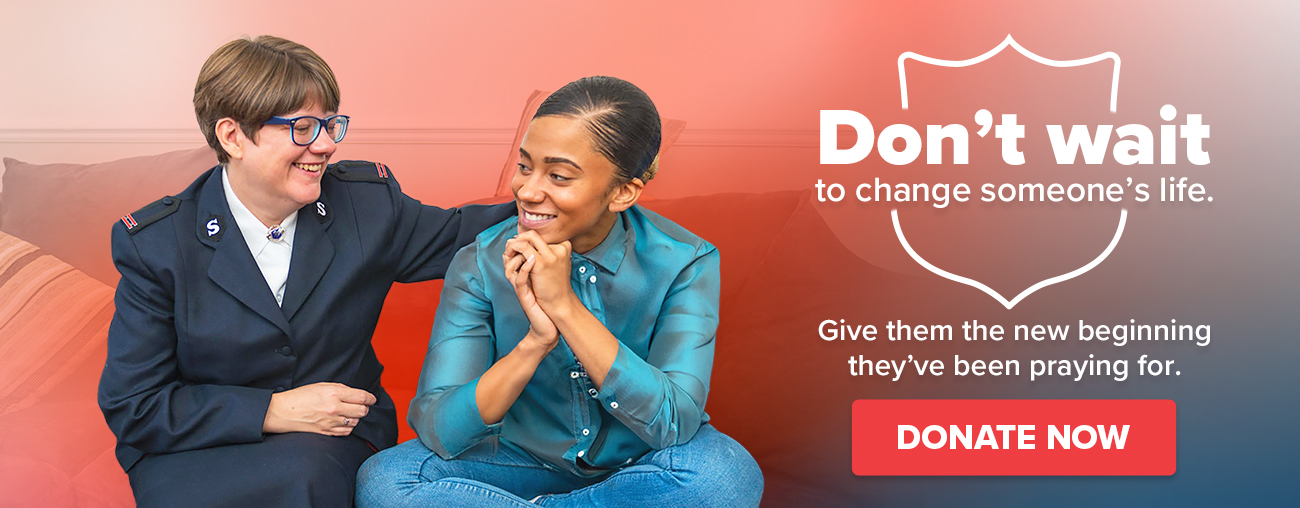

The Salvation Army exists to meet human need wherever, whenever, and however we can.